Book MYR23000 No SST eBook MYR24380 including SST Malaysia Master GST Guide 2017 provides a clear concise and practical explanation of Goods and Services Tax GST in Malaysia. Create 2 entries first entry select as Purchase P.

Written by Stanley K Wong.

. Enter the last date of the GST period eg 30 June. Mana-mana orang yang dinyatakan di dalam Perintah Duti Kastam Pengecualian 2017 adalah layak untuk dikecualikan daripada pembayaran duti kastam tertakluk kepada syarat-syarat serta barang-barang yang telah ditetapkan dalam perintah tersebut. For purchases with input tax where the GST registered entity elects not to claim for it.

LIST OF REGULATIONS. Goods and Services Tax Regulations 2014. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

10 sales tax 020 6 GST 012 Price paid by hotel 220 212 Input tax credit nil -012 Cost to hotel 220 200 Mark up 100 220 200 Selling price before tax 440 400 Tax 6 service tax 026 6 GST 024. Journal entry to reverse the negative amount in GST-03. From 27 October 2017 GST relief on the importation of big ticket items It is proposed that GST relief be granted on the importation of big ticket items such as aircrafts ships and oil rigs by companies in the aviation shipping and oil and gas industries.

The existing standard rate for GST effective from 1 April 2015 is 6. Jun 27 201727 June 2017 We request you to kindly suggest our Products GST HSN Code and rate of Tax. Collection of tax in designated area.

Power of minister to impose tax. SST - Sales Tax Act - Reference from RMCD. Goods and Services Tax Review and Appeal Regulations 2014.

We didnt understand rate rates and code websites. Mastering the New and Revised GST Tax Codes. Negative amount shown in GST-03.

Sales tax is only applicable to taxable goods that are manufactured or imported into Malaysia. Declaration of goods supplied from designated area to Malaysia. Malaysia are taxed at 19 on chargeable income up to RM 500000 with the remaining chargeable income taxed at 24.

Richard Thornton Thenesh Kannaa. Exported manufactured goods will be excluded from the sales tax act. Ltd and NSIL as recommended by GST Council in its 42nd meeting held on 05102020.

Goods and Services Tax Provision of Information Regulations 2017. The sales tax rate is at 510 or on a specific rate or exempt. GOODS AND SERVICES TAX AMENDMENT REGULATIONS 2017 AMENDMENT OF FIFTH SCHEDULE IN RELATION TO FORM GST-03.

There are 23 tax codes in GST Malaysia and categories as below. The GST in Malaysia replaced the Sales and Service Tax which was introduced in the national taxation system in 1970s. GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer.

Malaysia Indirect Tax April 2017 Indirect Tax GST Chat All you need to know Issue 042017 In this issue 1 GST Technical Committee Meeting Update 2 Update of the National Essential Medicines List and the Controlled Drug list 3 Changes to the Customs and Excise Duties Orders Other tax information Deloitte Contacts. SST - Sales Tax Act 1972. In force where any supply is made for a consideration every person who is liable to pay tax.

To amend notification No. GOODS AND SERVICES TAX ACT 2014. The extract of Section 33 of CGST Act2017 quoted below.

Income that is attributable to. The GST relief is only for an approved list of goods and subject. The tax was a consumption one and the change Malaysia Indirect.

Potential Out of Scope Supplies Items and Box 15 GST-03. A a taxable supply standard-rated or zero-rated. 12 2017- State Tax Rate so as to exempt satellite launch services provided by ISRO Antrix Co.

Please click on the title to download the list s. Goods and Services Tax Advance Ruling Regulations 2014. 33 Amount of tax to be indicated in tax invoice and other documents.

Valuation revised as at 18 January 2017. Sundry Book 2016 As at 1 December 2015 List of Taxable Goods and Non Taxable Amendment 12017 List of Taxable Goods and Non Taxable Amendment 22017. The Correct Accounting Application of Tax Codes Chartered Tax Institute of Malaysia and an approved GST Tax Agent.

Sila rujuk pautan berikut untuk maklumat lanjut. This tax code needs to be declared in column 6 a of the GST03 return. Scrub PadGreen Pad 8.

Supply revised as at 13 February 2017 Tax Invoice and Records Keeping revised as at 6 January 2017 Transfer of Business as a Going Concern revised as at 21 March 2017 Transitional Rules revised as at 3 August 2016 GST Guide on Amendment Return GST-03. This book is an invaluable tool for tax advisers and accountants in public practice as well as those in the corporate and. Notwithstanding anything contained in this Act or any other law for the time being.

Be aware of the transaction date you enter. In order to reverse the negative amount from column 5b to 6b you need to pass the following journal entry. Many domestically consumed items such as fresh.

A new tax code at the rate of 0 need to be created TX-0 or any code that the company uses for standard rated local purchase at 0 on or after 01 June 2018. Please be informed that with effect from 1 January 2018 details in item 15 of GST-03 return will be amended from Total Value of GST Suspended under Item 14 to Total Value of Other Supplies. General Guide revised as at 24 August 2017 Handbook for GST for Businesses.

GST Electronic Services Taxpayer Access Point TAP Handbook. Written by Stanley K Wong. Finance Bill 2017 GST Act 2014 Finance Act 2017 Finance Act 2015 Finance Bill 2015 Finance Bill 2016.

The Goods and Services Tax is an abolished value-added tax in Malaysia.

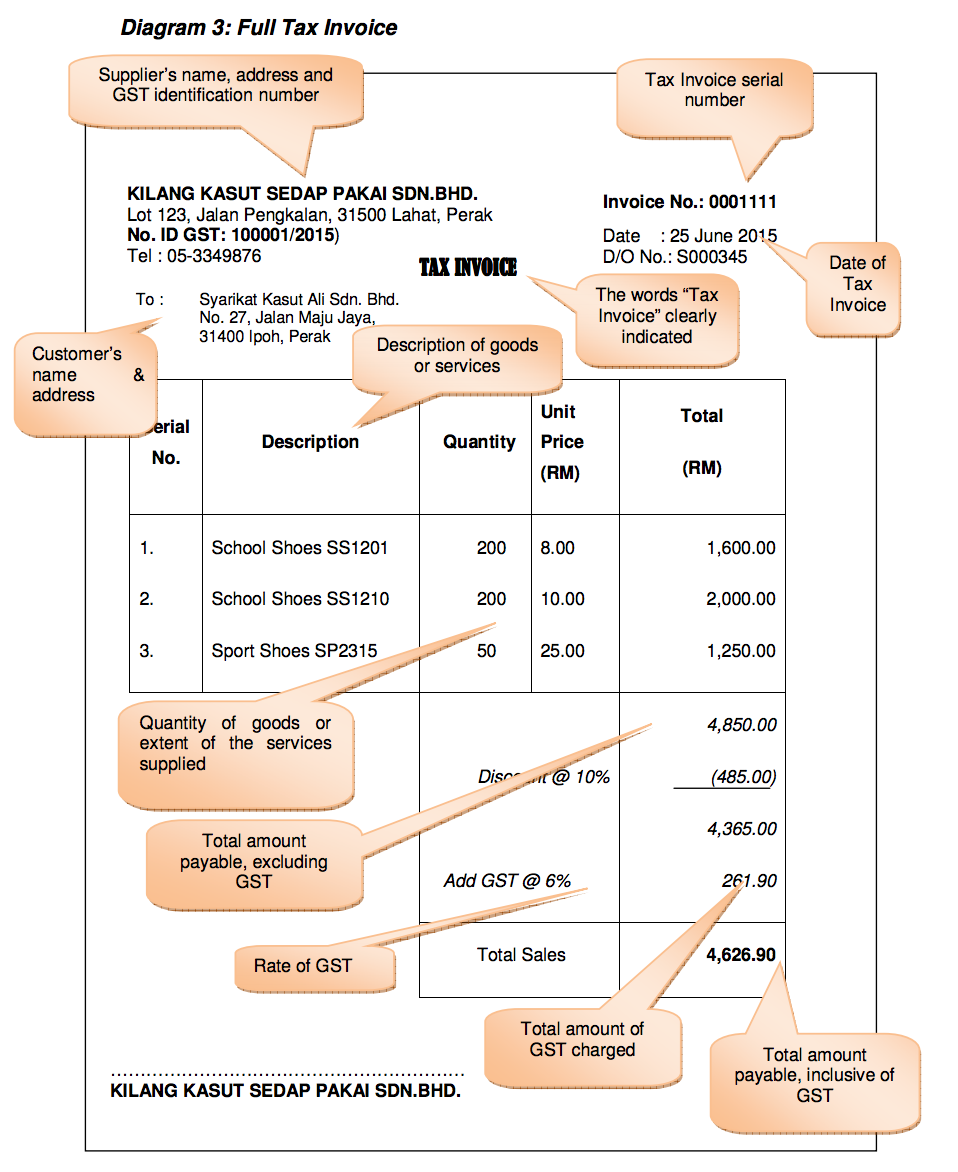

Basics Of Gst Tips To Prepare Gst Tax Invoice

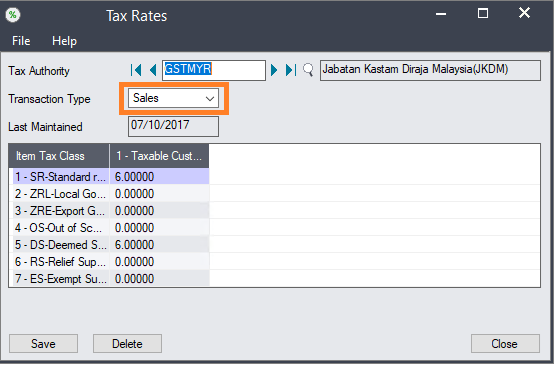

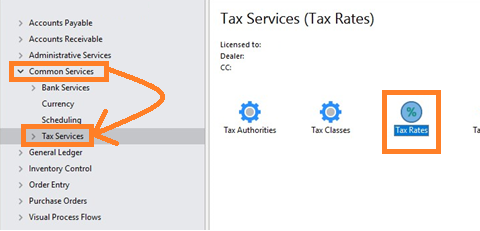

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

How To Configure Gst Taxation In Woocommerce

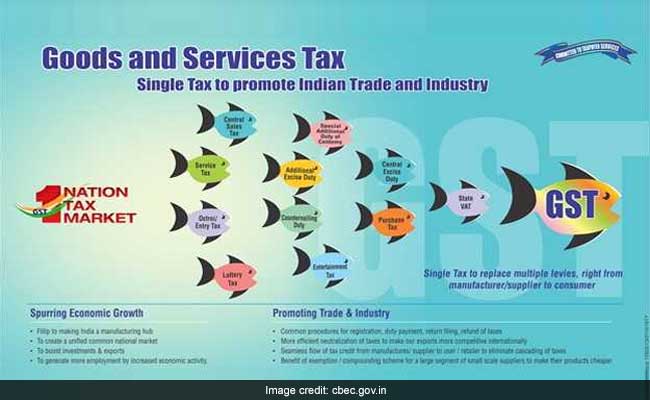

Gst To Subsume Sales Tax Vat Service Tax And Much More Details Here

Tax Codes Goods Services Tax Abss Accounting Malaysia

Pdf Goods And Services Tax Gst In Malaysia Behind Successful Experiences

Basics Of Gst Tips To Prepare Gst Tax Invoice

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

The Brief History Of Gst Goods And Service Tax

Gst Portal Provides Simple To Use Offline Utility For Uploading Invoice Data And Other Records For Creating Gstr 1 Accounting And Finance Worksheets Offline

Malaysia Tax Invoice Format Additional Summary Of Sub Total For Different Tax Codes Manager Forum

Setting Gst To 0 In Sage 300 Sage 300 Malaysia

Setting Up Taxes In Woocommerce Woocommerce

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll